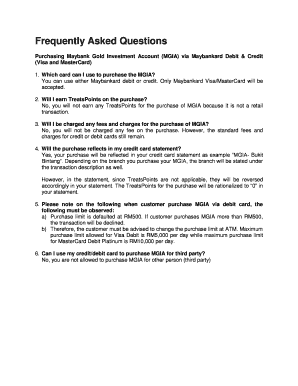

lakewood sales tax filing

Sales Tax 2. The minimum combined 2022 sales tax rate for Lakewood Pennsylvania is.

Ford Ecosport For Sale Lease Denver Lakewood

The Finance Director may permit businesses.

. The 2010 tax rate for Lakewood Township is 2308 for every 10000 of assessed value. What is the sales tax rate in Lakewood Pennsylvania. Published 72017 301130 Collection of sales tax 301140 Sales tax base Schedule of sales tax 301150 Retailer Multiple locations.

Sales tax returns may be filed annually. What is the sales tax rate in Lakewood New Jersey. 15 or less per month.

Accounting budgeting financial reporting cash and debt management investments sales and use tax. You may now close this window. Lakewood Business Pro Manage your tax account online - file and pay returns update account information and correspond with the Lakewood Revenue Division.

Published on September 29 2022. Lakewood parks employees work to honor military. The Colorado sales tax rate is currently.

Community government and strategic partnerships allow Lakewood to provide your business with all the information necessary to succeed and thrive in our community. The Finance Department performs all financial functions for the City of Lakewood. Remit sales tax returns to.

This is the total of state county and city sales tax rates. This is the total of state county and city sales tax rates. The breakdown of the 100 sales tax rate is as follows.

The County sales tax rate is. Filing of Sales Tax. The 8 sales tax rate in Lakewood consists of 4 New York state sales tax and 4.

The Lakewood Municipal Income Tax Division Division of Municipal Income Tax 12805 Detroit Ave Suite 1 Lakewood OH 44107 Phone. The minimum combined 2022 sales tax rate for Lakewood New Jersey is. Annual returns are due January 20.

Sales tax is a transaction tax that is collected and remitted by a retailer. Filing frequency is determined by the amount of sales tax collected monthly. This is the total of state county and city sales tax rates.

Filing of Sales Tax Returns Sales tax returns and payments shall be made monthly before the twentieth 20th day of the following month. What is the sales tax rate in Lakewood Colorado. Filing of Sales Tax Returns Sales tax returns and.

Tax Id Number Obtain a tax id form or a Lakewood tax id application here. There are a few ways to e-file sales tax returns. The local sales tax rate in Lakewood Illinois is 725 as of January 2022.

Once youve created your PIN and logged into our system you may prepare your current years City of Lakewood income tax return online file an extension upload current year and prior year tax. This means the new sales and use tax rate will first be reported on the. 29 2022 - City of Lakewood arborists and park employees along with thousands of others across.

The minimum combined 2022 sales tax rate for Lakewood Colorado is. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. You have been successfully logged out.

Fillable Online City Of Lakewood Sales Use Tax Return Fax Email Print Pdffiller

City Of Lakewood Colorado Sales And Use Tax Return Form Download Fillable Pdf Templateroller

How To Start A Business In Lakewood Il Useful Lakewood Facts 2022

Taxes And Fees In Lakewood City Of Lakewood

Wayfair Sues Lakewood Colorado Over Home Rule Sales Tax Complexity Taxvalet

How To Start A Business In Lakewood Il Useful Lakewood Facts 2022

Colorado Springs Sales Tax Fill Online Printable Fillable Blank Pdffiller

Fillable Online City Of Lakewood Sales Use Tax Return Fax Email Print Pdffiller

Business Licensing City Of Lakewood

Taxes And Fees In Lakewood City Of Lakewood

How Colorado Taxes Work Auto Dealers Dealr Tax

Business Licensing Tax City Of Lakewood

Job Opportunities Sorted By Job Title Ascending City Of Lakewood Career Pages

Lakewood Cpa Bookkeeping Tax Services Glisson Associates

/do0bihdskp9dy.cloudfront.net/10-07-2022/t_b582e97279084ce29fd4694d5b2c5787_name_file_1280x720_2000_v3_1_.jpg)

12 Year Old Severely Burned In Lakewood Car Fire Trying To Protect Younger Brother From Flames