why are reits tax efficient

For this reason I recommend you hold your REITs in an. The Tax Cuts and Jobs Act TCJA passed into law in 2017 further enhanced the tax efficiency.

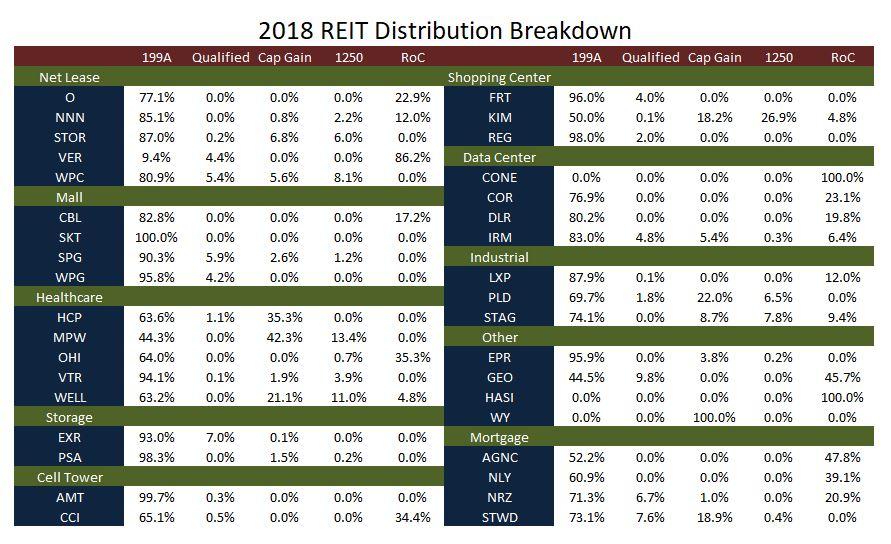

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Theres another reason to put REITs in tax-advantaged accounts.

. Ad Each of these 3 companies pays around 10 to its shareholders annually. In exchange for paying out at least 90 of taxable income to shareholders REITs. While REITs are less tax efficient than qualified dividend-paying US equities the extent of their inefficiency is overstated and misunderstood.

Tax Efficiency By holding a REIT in my Roth I can lower my tax rate on REIT income from 24 to 0. Find out why tax-efficient investing is important and how it can save you money. REIT dividends are usually not considered qualified so they are taxed at whatever your marginal tax rate happens to be.

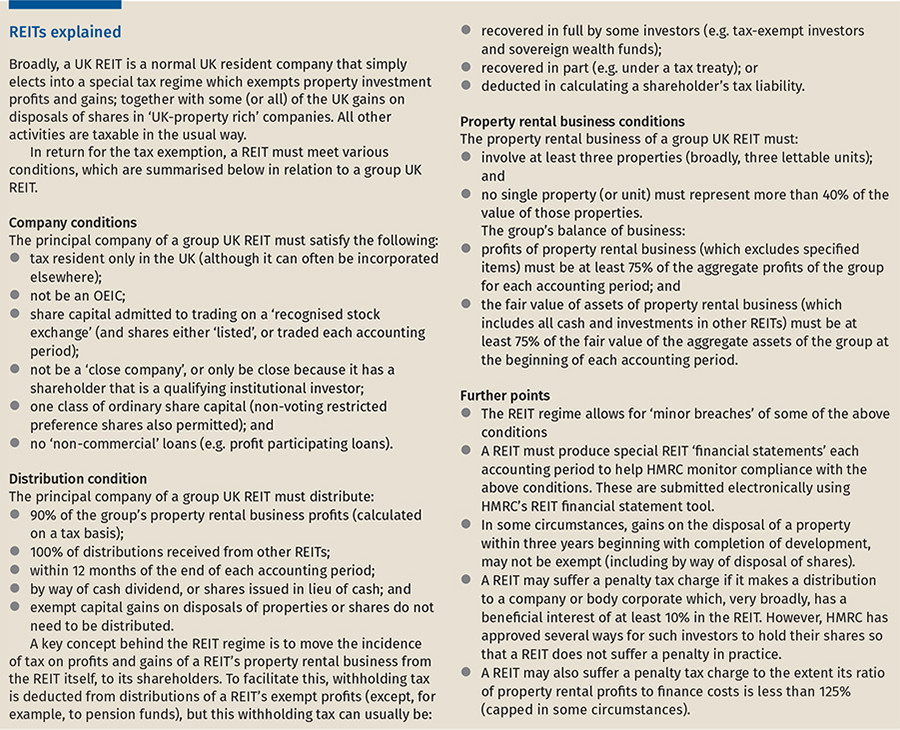

A REIT is a tax-efficient vehicle that gives people exposure to a diversified portfolio of income producing properties. Ad We Advise More REITs than Any Other Professional Services Firm. A REIT or real estate investment trust is a company that owns operates or finances real estate.

The bill featured a new 20 percent tax deduction for pass-through entities. Theres another reason to put REITs in tax-advantaged accounts. It can be a way for you to invest less capital so that in 5 10 or 15 years.

Our Knowledge Experience and Capabilities Make Us the Leader in Serving REITs. Ad Learn How Bank of America Private Bank Can Help You Explore Alternative Investment Options. It is certainly a reason to invest in Reits through various tax wrappers but at this stage another.

Get your free copy of The Definitive Guide to Retirement Income. Ad Learn How Bank of America Private Bank Can Help You Explore Alternative Investment Options. Take that income through a tax-efficient pension or tax wrapper and the benefits become clear.

Long-term capital gains are taxed at lower. REITs are a tax-efficient diversified alternative to direct real estate ownership and investment. Real Estate Investment Trusts REITs are known as a tax efficient way to invest in real estate.

Rather than having to buy and maintain actual physical real estate properties investors can. Tax-efficient investing can minimize your tax burden and maximize your returns. This company is required by law to distribute 90 of its taxable income to shareholders.

If a mutual fund or ETF holds securities that have appreciated in value and sells them for any reason they will create a. ETFs are vastly more tax efficient than competing mutual funds. REITs pay out roughly 65 of their distributions.

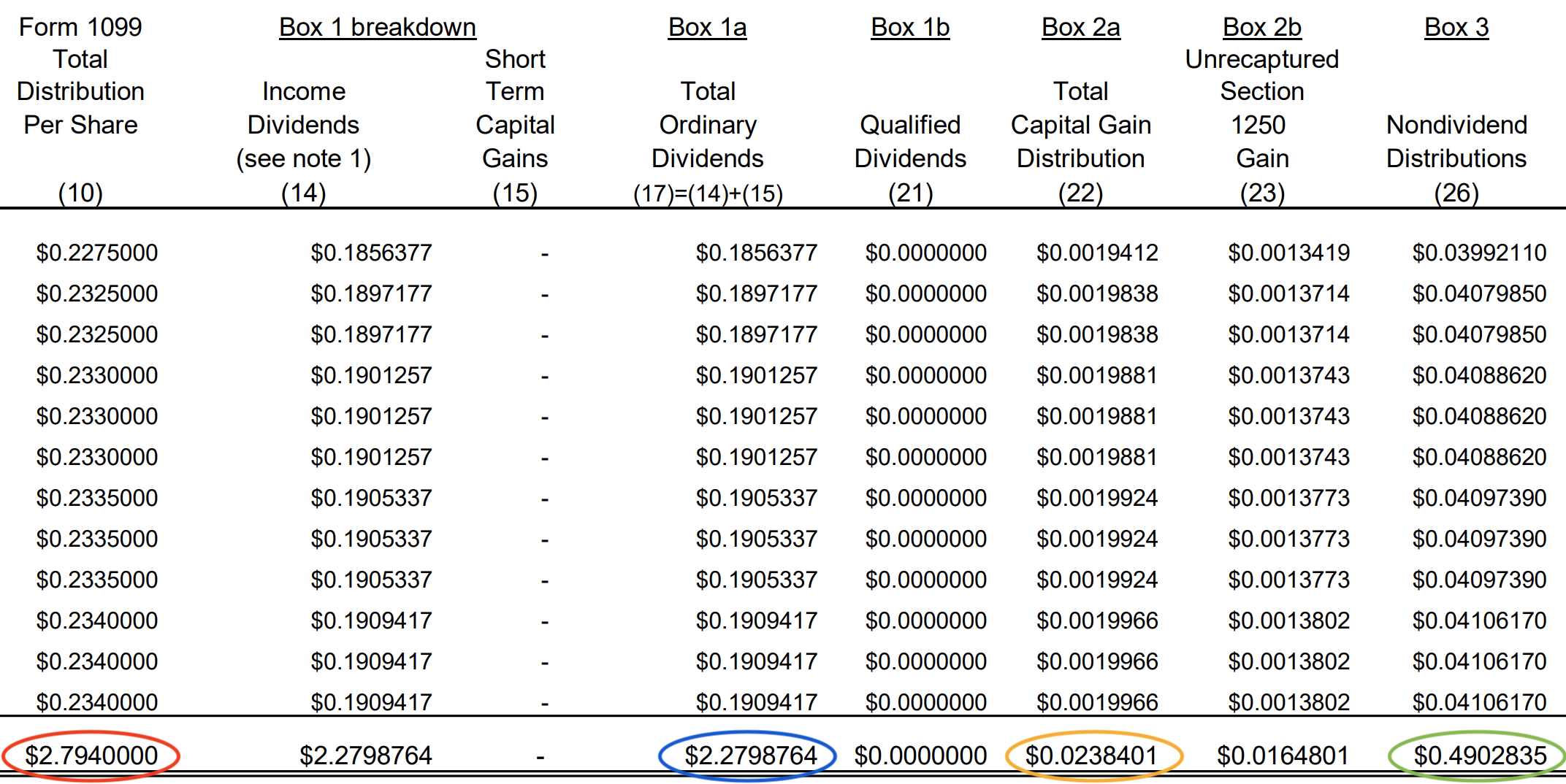

An analysis of Burton G. Tax rates on dividend distributions from the REIT. This occurs when a REIT sells a property that it has owned for over a year and chose to distribute that income to shareholders.

When looking at after-tax total. Individuals are now permitted to deduct up to 20 of ordinary REIT dividends. Heres the math for such a taxpayer.

Learn What We Can Do. We view valuations on REITs as attractive relative to the broader equity markets based on our multi-asset real return framework. Ad Learn the basics of REITs before you invest any of your 500K retirement savings.

Their dividend tax rate is much higher than dividends on stocks. This 20 pass-through deduction reduces the top tax rate on REIT dividends from 396 to 296 for a taxpayer in the highest tax bracket. Further REITs recently became even more tax efficient under the new 2017 Tax and Jobs Cuts Act.

Investing in a REIT is an easy way for you to add real estate to. REITs by their very structure are not particularly tax-efficient As long as a REIT pays out more than 90 of net income it pays NO corporate taxes so there is no double. That provides a slight reduction in tax rates while simultaneously amounting to an after-tax savings.

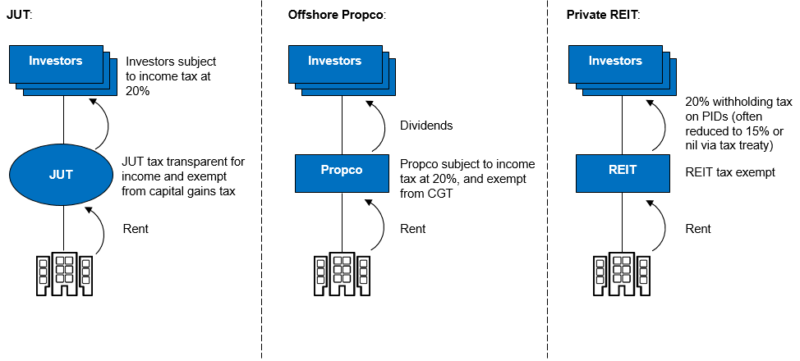

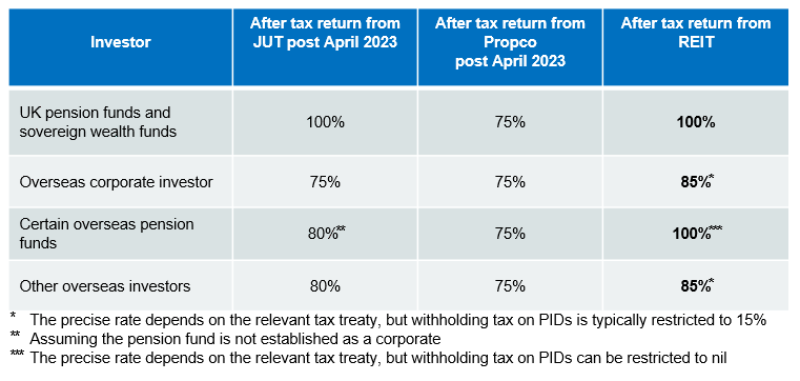

Shareholders may then enjoy preferential US. This section of the article examines why funds use REITs for the benefit of foreign investors how various types. Potential Market Inefficiency Due to the weird legal structure of.

REITs historically have delivered competitive total returns based on high steady dividend income and long-term capital appreciation. Their comparatively low correlation with other assets also.

Tax Lien Investing Simple Diy Investing For 18 Returns Diy Investing Investing Real Estate Investing

The Continuing Rise Of The Reit

7 Proposed Changes To Ira Accounts And How They Could Alter Your Retirement Plan Investing For Retirement Retirement Planning How To Plan

Guide To Reits Reit Tax Advantages More

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Guide To Reits Reit Tax Advantages More

10 High Dividend Etfs For Income Seeking Investors Plain Finances Dividend Financial Motivation Dividend Investing

According To Case Shiller Us Housing Has Paused On Its Way Down Marketing Set Housing Market Marketing

5 Tax Planning Fundamentals For Investors Investing Investing Strategy Tax

Pin On Financial Planning Tips

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Rental Properties For Passive Income 5 Things I Wish I Would Have Known Fir Real Estate Investing Rental Property Real Estate Education Real Estate Investing

Taxation Of Reits Ringing In The Changes

The Continuing Rise Of The Reit

How Tax Efficient Are Your Reits Seeking Alpha

Personal Equity And Retirement Account P E R A In The Philippines Retirement Accounts Equity Retirement

Reits 101 Do You Know The Risk And Benefit Of Reits Investing Money Management Books Investing Strategy